What We Need Our Auditors to Do

Author: Mark Funkhouser

This article talks about what we need our auditors to do. He starts off talking about a 56 slide powerpoint he had to sit through while at a National Intergovernmental Audit Forum. He talks about how the government auditors must focus on program effectiveness so that we can use that information to inform policy makers officials and the people when tough decisions need to made. Then he goes into talking about how the the job of an auditor is getting harder and that there are less staffers to fix the problem. He talks about how the state and local governments should not make so many cuts on auditing firms because “cutting back in those areas to save money is like trying to lose weight by shrinking your brain.”

I think that this is an important source on the subject because it talks about the problem of auditors being cut and it is hard for auditing to be done if there is no one there to do it. The article states that targeting and technology will help provide more effective auditing. Well this addresses a problem in the auditing world and gives a good answer to the problem. As they stated in the article we need our auditors to do better because if they are not effective in doing their jobs then policy makers and the people will not be able to get the information they need when it is time to make tough decisions.

The author of this article should definitely expand upon technology and targeting. People should read up of the different technologies on how to fix this auditing problem and effective targeting methods so that the auditors can pinpoint and target the right places. Another thing to read about is different local governments and state governments that have successful auditing practices and those that do not have such success and compare them so we can identify problems on those levels. Also it would be nice to know what else goes on at a National Intergovernmental Audit forum as well.

The Corporate Scandal Sheet

Author: Penelope Paturiss

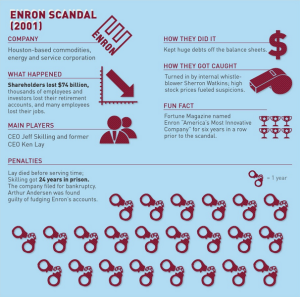

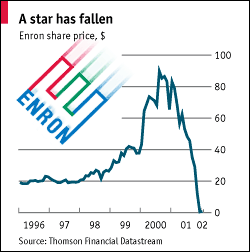

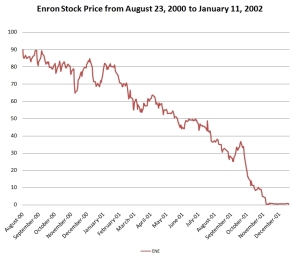

This article talks about various auditing scandals that have occurred. There are multiple companies in this article from places like Kmart (2002), Halliburton (2002), Enron (2001), El Paso (2002), Global Crossing (2002), Duke Energy (2002), Bristol-Myers Squibb (2002), Reliant Energy (2002), and WorldCom (2002). These are just a few of the names on the list and there are many known companies on this list as well. This article also categorizes the company, when the scandal went public, allegations, investigating agencies, latest developments, and the company’s comments.

This article is interesting for research because it brings up different scandals that have gone public. Also when you know how these scandals are being committed then it will be easier in the future to spot these problems again and correct them in a timely manner. Another reason why it is good for research because it shows how companies respond when they get caught and how they conduct themselves afterwards. Seeing the consequences of the scandals can help prevent others from committing the same fraud. This also is good for research because it can help prove why we need government auditors to step up as well.

It would be nice to research the auditors methods on how they found the problem and the steps they took to correct the problem. Also the different holes they found that busted the companies frauds wide open so that other auditors can know the signs and pinpoint them and correct them so that these problems won’t arise again. Another thing that would be nice to further research are more recent events in which auditors have busted open accounting scandals as well since this list ends in 2002.

Materiality Considerations

Authors: William Holder, Kenneth Schermann, and Ray Whittington

This article talks about how preparers and auditors of state and local government financial statements need to clearly understand how to assess materiality. This article discusses current concepts and standards related to the preparation and audit of the basic financial statements of state and local government entities. It goes on to talk about materiality in accounting and auditing, materiality and GASB(Government Auditing Standards Board) 34, GASB’s Implementation guide, and the new AICPA Audit and Accounting Guide. This article then goes on to talk about the how evaluating materiality is complex, and how it involves quantitative as well as qualitative considerations.

This article is good for research because it talks about issues involving the preparation of financial statements. It focuses on how state and local governments introduced changes and how those changes make it even more critical for preparers and auditors to understand the materiality and other related standards. The visual used in the article which focuses on the the Overview of reporting Units and Opinion Units is also very helpful as well as it breaks different levels in the GASB’s implementation guide.

First off research the definition of materiality as it is not clearly stated in the text but for sure it is something that is an issue that needs to be addressed by auditors. For further research it would be nice if they talked more about the GASB and research the other sections that were not mentioned in the article. Also as well as that it talks about about the problems but go into different ways and research different methods on how to address the problems of materiality and the lack of preparation in the government when it comes to this . Another thing to consider in further research is how the auditor themselves can improve now that they know the problems and how to go about solving these problems and giving them help to solve these problems as well. But it is always good to look at other articles as well that pretain to this subject of auditors and materiality

portant. Last week we talked about changing the audit structure. I completely agree with that because the current audit structure is tough. I am going to talk about how it is important to help our auditors so that they may be more efficient and more effective when it comes to doing their jobs.

portant. Last week we talked about changing the audit structure. I completely agree with that because the current audit structure is tough. I am going to talk about how it is important to help our auditors so that they may be more efficient and more effective when it comes to doing their jobs. end things up to the chain of command for approval they would just send it electronically. This made it more efficient but at the same time though I had to scan hundreds of documents and thousands of papers day after day so that the archives and other audits could be accessed easily. It was tough work. I everyday things would start to pile up and my desk would look the desk of the normal employees and I’m just an intern.

end things up to the chain of command for approval they would just send it electronically. This made it more efficient but at the same time though I had to scan hundreds of documents and thousands of papers day after day so that the archives and other audits could be accessed easily. It was tough work. I everyday things would start to pile up and my desk would look the desk of the normal employees and I’m just an intern.