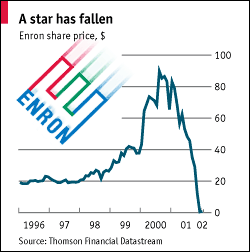

The procedure that we would like to see enacted entails a government agency conducting audits on large companies prone for missteps or fraud. There are many procedures currently in place that could theoretically circumvent the need for such an agency if they were conducted properly. As we have discussed earlier, they are prone to bias and inaccuracies. Miklos Vasarbelyi, Alexander Kogan, and Michael Alles of the CPA Journal talk about the possibility of continuous auditing eliminating the possibility of such an agency being created. Well, not directly, but we can most certainly apply it to our proposal. In their article, titled “Would continuous auditing have prevented the Enron mess?”, they analyze the preventative worth of continuous auditing, a method that is conducted within a company, much like internal auditing. Unlike internal audits, continuous auditing or continuous assurance monitors transactions and compares actual results to expected or calculated ones. If there is any discrepancy, the supervisor can address the issue only hours, if not minutes after it happened, rather than in a traditional system, where several days or weeks may pass before any inconsistency is uncovered.

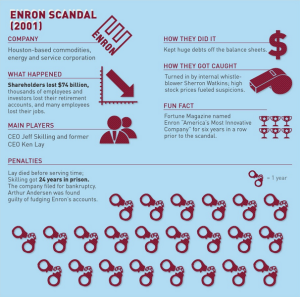

Graphic from http://www.accounting-degree.org/scandals/

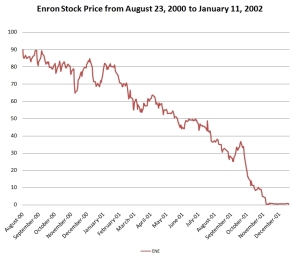

So could it have stopped the Enron mess? Assuming that a continuous audit would pick up on the massive accruing debts of Enron, we still have to look at the subjective nature of any internal operation, which is talked about in the article, questioning its own conviction of the idea. Seeing that Arthur Andersen, one of the world’s largest audit and accountancy partnerships, was pulled into the scandal, presuming some monetary gain by the conspirators fudging the books, it is even more conceivable that one of the companies own higher-ups would have some reason for overlooking debts being amassed.

“Tighter regulation can be devised and implemented…”

A continuous auditing system seems as it has a good set of procedures that would fit perfectly with government monitoring. Obviously not every company could be monitored through this system, at least not without significant effort and technology on the government’s part. Perhaps companies at a higher risk for fraud or lack of appropriate auditing. These would include rapidly growing companies with hastily swelling stock prices and companies that have little to no physical assets, such as software companies, which we are seeing a candid rise in. Having a high margin of liquid assets as opposed to physical increases the potency of bankruptcy, as no returns to investors or lenders can be distributed.

The article itself say that times have changed and outgrown old procedures and “Tighter regulation can be devised and implemented…”, showing that this is not such a radical a new idea, simply a sensible one. Without trust in our nations economy and the companies that we see on the stock ticker everyday, we will see a striking decline in many spheres, not just the economy.